Wealth and estate services

Browse by

-

Common wealth transfer mistakes (national edition)

Transferring assets to the intended beneficiaries doesn't always go as planned. Here are the common mistakes to watch out for.

Read more -

RRSPs and RRIFs on death

What happens when an RRSP owner dies? At death, RRSPs and RRIFs are fully taxable. By naming a qualifying survivor as a beneficiary, tax can be deferred. There are many questions to answer about tax reporting at death. We discuss some common ones.

Read more -

Common estate planning mistakes in Quebec

Transferring assets to the people you want in the way you want doesn't always go as planned. Here are the common mistakes to watch out for.

Read more -

Keeping the family cottage in the family

Passing on a family cottage? Half of any increase in value is taxable at death. This strategy protects against an estate having to sell a cottage to pay the tax.

Read more -

Changes to the capital gains tax—what could they mean for you?

The 2024 federal budget proposed changes to the capital gains tax. See how they may apply to you, and what they could mean for your retirement planning.

Read more -

How will the changes to capital gains affect you?

In this episode of our quarterly webinar, we take a close look at the impact of the federal budget on Canadian high-net-worth investors, specifically the changes to capital gains.

Read more -

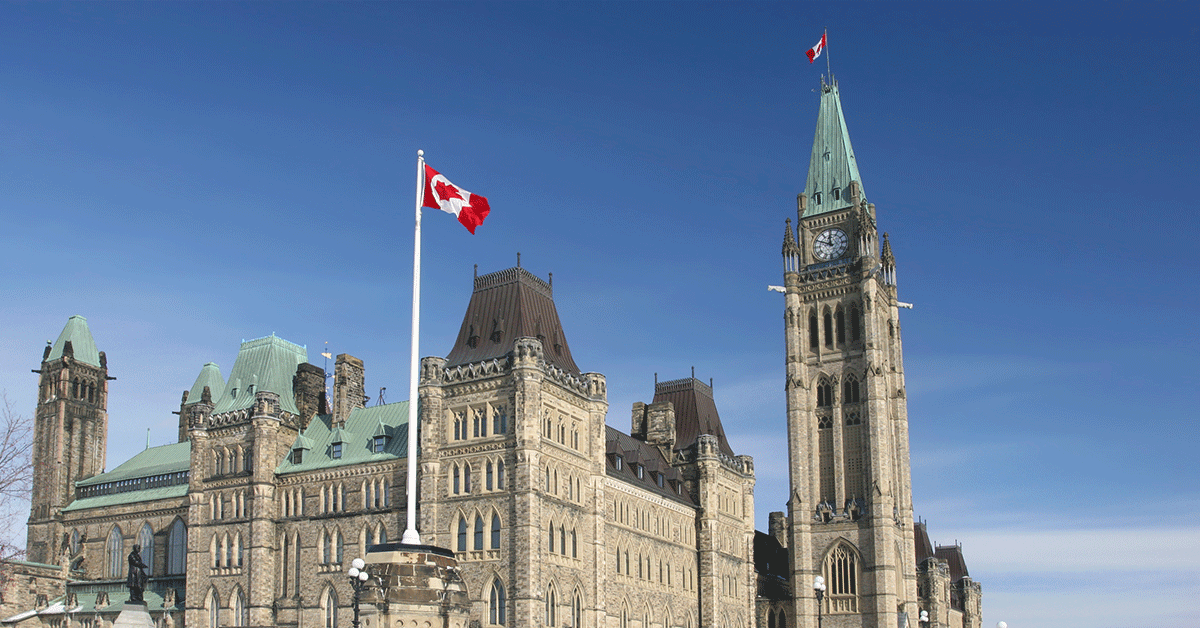

Federal budget 2024 highlights

We’ve reviewed the budget and compiled a summary of the key highlights we think are most important for sponsors, consultants, and financial advisors.

Read more -

Federal Budget 2024: addressing long-term challenges takes time

The federal government's latest budget contained nuggets that would be of interest to everyone―from investors to first-time homebuyers and economists who are concerned about Canada's deficit picture. Learn more.

Read more -

Federal budget 2024―and you thought there would be nothing?!

A summary of the 2024 federal government’s budget highlighting the changes delivered by the Liberal government on April 16, 2024. Review our analysis of the key corporate and personal measures and how they impact you.

Read more -

Understanding trusts

Trusts can be used for your estate-planning and wealth-succession goals. Learn more about trusts: formal vs informal trusts, attribution rules, 21-year deemed disposition, preferred beneficiary election, trustee duties, and tax compliance.

Read more

---viewpoint/CRINV-15114_Federal-Budget-Summary_Dominique-Lapointe_Viewpoint_HERO_FINAL.jpg)